Transaction

Disclaimer

Tight stop-losses in options trading may not work due to options' sensitivity to volatility, wider bid-ask spreads, intraday price swings, and susceptibility to market noise.

Please note that Deep ITM options often have lower liquidity, making it challenging to enter or exit positions at desired prices, leading to potential slippage and increased trading costs.

Frequently asked Questions for Transactions

1.How to use Limit Order Buffer Percentage to reduce Slippage?

Users can see this option before creating Live Run. Let’s discuss this feature with some examples.

Let’s imagine you are buying call option leg with 200 premium and you don’t want to take a trade if slippage is 2%. If premium between 200 to 204 (2% slippage), you are ok to take a trade. If premium increase more than 204, then you don’t want to take a trade. Users can setup this configuration in their strategy by using Limit Order Buffer Percentage. If user gives 2% in Limit Order Buffer Percentage, then Quantman will take entry if premium between 200 to 204. If price is going beyond that premium, Quantman ignore the entry and it will wait for next entry.

Note: you have to give 1+ number of transactions per day in strategy if you want to take more than one entry on same day.

2. How to use Stop limit price Difference to reduce Slippage?

Users can see this option before creating Live Run. Let’s discuss this feature with some examples.

Let’s imagine user created strategy where buy call option premium around 200 and stoploss 30% so we expect our trade should exit when premium hits 140. In this case users can provide Stop limit price Difference as 2% to 4%. Quantman notify broker when premium comes 170 so that broker will make sure the trade exit without much slippage. Sometimes due to Market jump up / jump down the price variation will be fast, during that market conditions, this option will minimise slippage while stoploss hits.

3.How to generally calculate slippage for Quantman back tested strategies?

Buying strategy: Please consider 1% Slippage

Selling strategy: Please consider 0.5% Slippage

When we back test any strategy, Quantman provide you the results without slippage first. Please provide the slippage percentage based on above simple calculation and check the value after slippage so that your back test results will match approximately with live run.

4. How to use Re-Entry adjustment in my strategy?

Quantman introduced many adjustments features to become reasonable trader in volatile market. Let’s discuss one by one.

Stop Loss is Mandatory to use this custom adjustment in your strategy. Please set stoploss for all option legs you use in your strategy before using adjustment feature.

Re-Entry

When we create strategy, we set up option legs based on premium or Future based strike. Let’s imagine your option leg hits stoploss and you want to re-try option leg once again with same strategy condition, we can use Re-Entry option.

When you enable Re-Entry in your strategy, it is mandatory to provide maximum number of times you want to Re-try. You can provide up to 5.

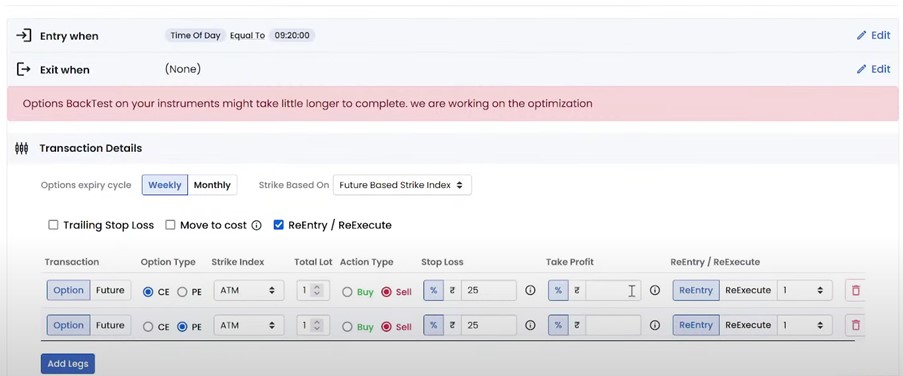

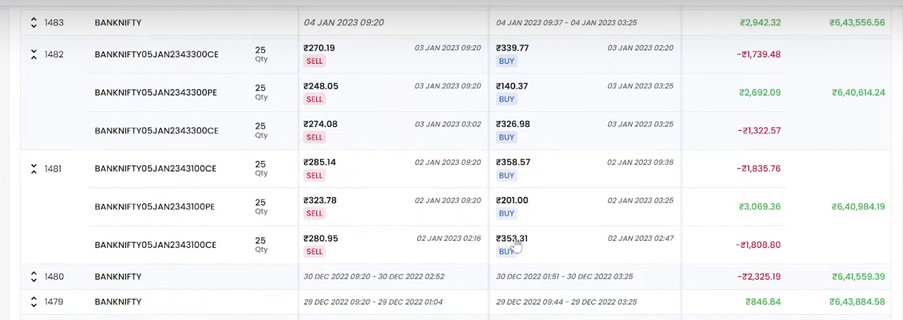

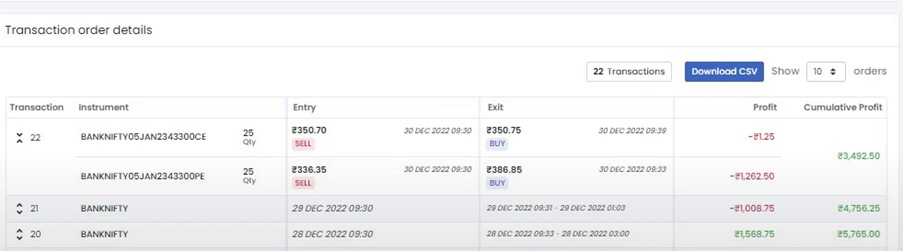

Let’s Discuss with example. We consider Bank Nifty Straddle strategy. Below is the strategy

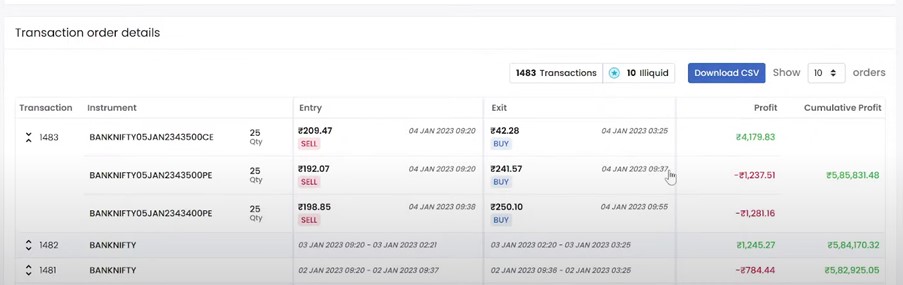

By referring below screenshot, 43300 CE hits stoploss and trade exit around 2:20 PM. Then Quantman waits till same strike 43300 CE comes near 270 and then re-entered around 3:02 PM.

Even though you exit trade with loss due to market volatility, you can re-enter once again when same conditions met again so that there will be another chance for the expected move.

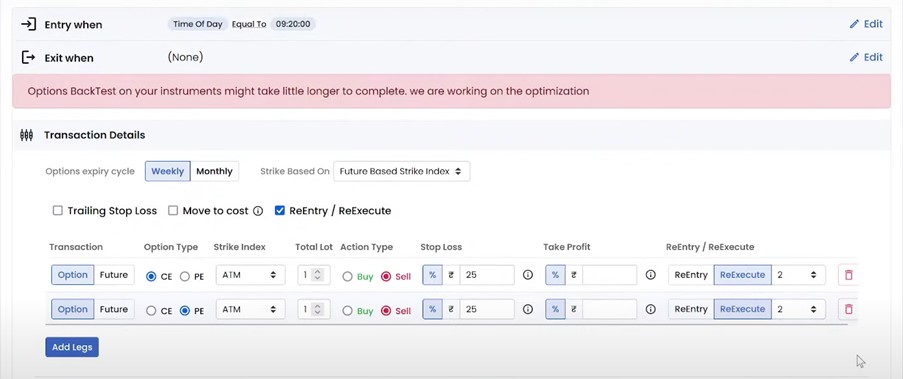

5.How to use Re-Execute adjustment in my strategy?

When we create strategy, we set up option legs based on premium or Future bases strike. Let’s imagine your option leg hits stoploss due to market volatility and you want to re-try option leg without waiting, we can use Re-Execute option.

When you enable Re-Execute in your strategy, it is mandatory to provide maximum number of times you want to perform Re-Execute option. You can provide up to 5.

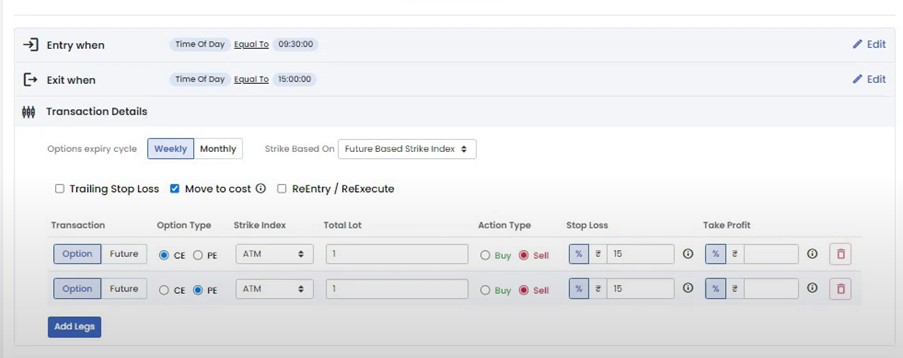

Let’s Discuss with example. We consider Bank Nifty Straddle strategy. Below is the strategy

By referring below screenshot, 43500PE option leg hits stoploss around 9:37AM. Quantman will place the order in the next minute open in ATM strike changed from 43500 PE to 43400 PE.

6. How to use Move to Cost adjustment in my strategy?

When we create strategy, we set up option legs based on premium or Future bases strike. Let’s imagine you deployed straddle strategy with 25% stoploss for each leg in live. If one option leg hits stoploss due to market volatility, Quantman will move stoploss of opposite leg from 25% to 0% Both Call option leg and Put Option leg is Mandatory to use this custom adjustment in your strategy. If you use only call option leg or only Put option leg, then this option will be disabled.

Scenario:

if CE & PE with 200 premium and Stop Loss 25% for both legs then stoploss hits when premium comes around 150.

Condition 1:

When CE option leg hits stoploss and other PE leg premium around 210 then Quantman will change PE leg stop loss from 150 to 200 again.so that if market condition is not favourable during market time and PE leg exit trade with 200 without further loss. So, loss will be minimised as only one leg exit with stoploss.

Condition 2:

When CE option leg hits stoploss and other PE premium around 198 then Quantman will exit trade for PE leg.so that further loss will be avoided for customer.

Move To Cost feature mainly introduced to avoid maximum loss for customer. If customer want to avoid further loss if one leg hits stoploss, then he can use Move to Cost feature. So that the opposite leg may exit trade with target value or at least exit without more loss.

Notes:

Please keep it in mind if you use more than one call option legs or more than one put option legs in strategy

Condition 1: if one call option leg hits stoploss, then Quantman will move all remaining put option legs stoploss to Entry price.

Condition 2: if one put option leg hits stoploss, then Quantman will move all remaining call option legs stoploss to Entry price.

7.How to use Trailing stop loss adjustment in Quantman strategy?

Trailing stop-loss feature allows you to place stop-loss which gets adjusted automatically as per the option premium movement in a favourable direction.

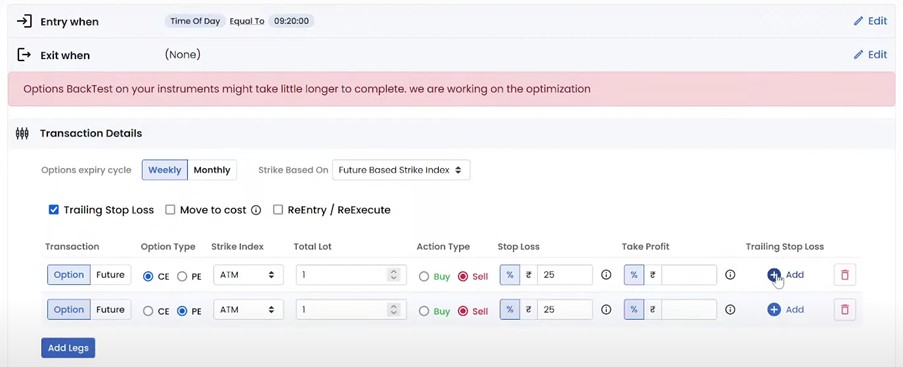

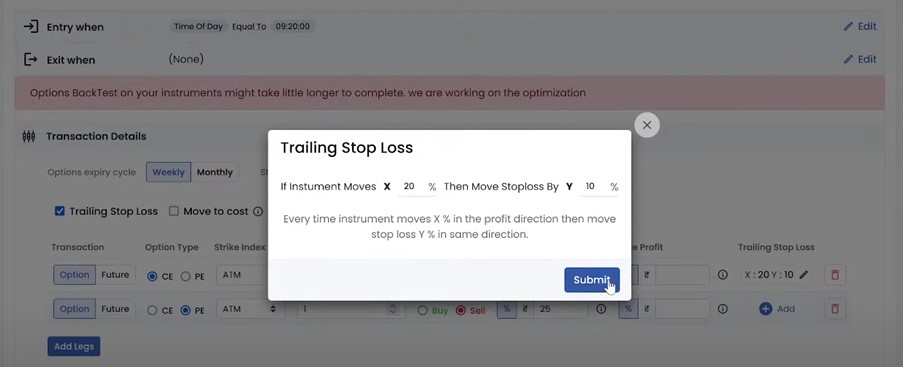

Please refer the below 1st screenshots where we created straddle strategy with ATM strike and enable “Trailing Stop Loss” and then click “Add” button in individual leg.

Please refer the below 2nd screenshots where new pop-up will open to provide values for trailing stop loss based on your strategy plan and click “Submit” button. Here in example, if Premium moving 20% in expected direction, we move stoploss 10% in same direction.

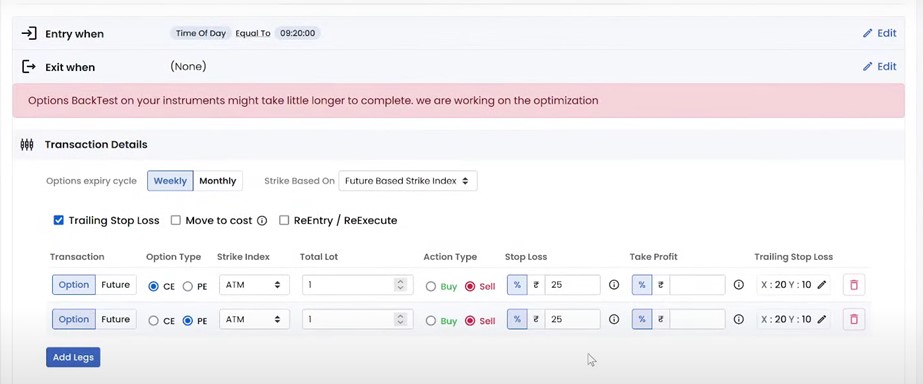

Please refer the below 3rd screenshots where our trailing stoploss values are visible for each option leg.

8. Is it mandatory to provide trailing stop loss in strategy?

No, it is only an optional feature. You can use it in Quantman based on your strategy outcome.

Example scenario:

Let’s say We buy option for premium 400 and Stop loss 10% (when premium 360) Trailing stop loss condition IF PREMIUM increases 10% then stoploss also move 5% on the same direction.

if Premium moves 440 then our Stop Loss will move from 360 to 380 (400*5%=20) – In this scenario, if market falls down the trade will Exit at 380 Premium so user will be in loss of 20 instead of 40.

if Premium moves 480 then our Stop Loss will move from 380 to 400 – In this scenario, if market falls down the trade will Exit at 400 Premium so user will be in NO LOSS. If we have not used Trailing Stop loss, User may end up in loss while exit trade.

9. Difficulties using Stop Loss in Quantman Strategies:

- My strategy hitting Stop Loss as soon as it took entry in Quantman and this is happening frequently. Why this is happening?

- My strategies are hitting Stop Loss frequently in live trade but I have reasonable result for back testing same strategy. Why this is happening?

- When I setup Stop Loss amount around 300 RS in my strategy, my trades hitting loss frequently. Why this is happening?

- When I setup Stop Loss amount around 300 RS in my strategy, I can see actually stoploss hits beyond amount 300 RS (like stoploss at 400RS or 450 RS like that). Why this is happening?

We often getting above questions from our Quantman users. All above questions pointing to single solution. That is Stop Loss setup management in your strategies.

If users provide stoploss amount around 300 RS (or low amount), trade will be in loss due to very low SL percentage. The Stop Loss amount will be very low if you use multiple lots on the same strategy. So, the trade will hit stoploss for small price variation in live market.

Since Live Market data will change tick by tick, the strategy may hit Stop Loss frequently due to low Stop Loss setup. But when we back test the same strategy, it may show the reasonable results. The reason because the back test data will be minute by minute data. But in live, within a sec there will be a chance that data may change with different values. When we setup low stop loss amount or low stop loss percentage which may results the trade hits Stoploss.

After Quantman place the orders in broker portal, it will take few sec to place Stop loss order in to broker portal. Within the few sec, the trade will hit stoploss due to low Stop Loss amount setup in user strategy.

When Market jump down or jump up happens due to volatility, it is difficult to exit the trade with exact Stop Loss as mentioned in strategy. Even this issue will happen in broker portal if you manually took trade without Algo. But Quantman will try to exit the trade as soon as the trade hits stoploss and it will Exit the trade faster than broker so that the user will not loss so much due to Market volatility.

How to avoid this issue?

Users will be advised to setup reasonable Stop Loss amount in their strategy so that the trade will not fail every time. For example, if user set 20 % stoploss on buying option strategy, even though there is a price variation due to Live market volatility, there is still a chance that the trade will end up as expected by staying in market more time.

Example scenario:

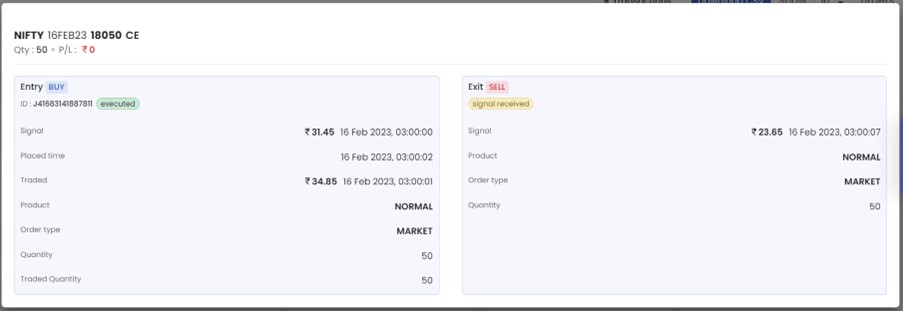

Please refer the below screenshot for Strategy transaction details. When user setup less Stop Loss percentage, the Entry will be taken in broker portal but in Exit, we will get status only as “Signal received” and position will not be closed in broker portal.

If User come across the above scenario, please consider providing reasonable Stop Loss to avoid that issue