Why Most Traders Fail Without Automation – The Secret to Consistency

Introduction

Trading in the stock market is an exciting yet challenging journey. Many traders enter the market with the hope of making consistent profits, but only a few succeed in the long run. The harsh reality is that most traders fail due to emotional decisions, lack of discipline, and inconsistent strategies. This is where automation and algorithmic trading (Algo Trading) come into play.

In today’s fast-moving stock market, relying solely on manual trading can be risky. Human emotions such as fear and greed often lead to poor decision-making, and by the time a trader executes a trade, the opportunity might be lost. Automated trading removes these difficulties, ensuring discipline, speed, and efficiency in trading.

This blog will explain why most traders fail without automation and how algorithmic trading helps them achieve consistency and success. We will also discuss how platforms like Quantman can play a significant role in simplifying the automation process for traders.

Why Most Traders Fail Without Automation

1. Emotional Trading

One of the primary reasons traders fail is emotional trading. When a trader enters the market, they often let emotions take control, leading to panic selling or greedy buying.

For example, imagine you are trading Bank NIFTY. You see a sudden dip in price, and fear takes over. Instead of following your strategy, you exit the trade in panic. Later, the market recovers, and you realize you made a mistake.

Similarly, when traders see rapid upward movement, they chase the market and enter trades too late, only to suffer losses when prices correct.

Automation removes this problem by following pre-defined strategies. The algorithm sticks to the rules without emotional interference, leading to better results.

2. Lack of Discipline and Strategy Execution

Many traders start with a well-defined plan but fail to execute it properly. They deviate from their strategy based on market noise, opinions, or sudden movements.

For example, let’s say you have a strategy for trading NIFTY 50 options where you sell calls and puts when implied volatility is high. But when you see unexpected price movements, you change your strategy midway. This inconsistency leads to losses over time.

With automation, every trade is executed precisely according to the plan. There is no second-guessing or hesitation, ensuring discipline and consistency.

3. Delay in Order Execution

Stock markets move within seconds, and manual traders often struggle to place orders at the right time. By the time you analyse a trade, enter the order, and execute it manually, the price may have already moved.

For example, in scalping Bank NIFTY options, every second counts. If you spot a trade but take even a few seconds to enter, you might lose the ideal entry.

Automated trading executes trades instantly based on predefined conditions, ensuring zero delay and maximizing profit opportunities.

4. Overtrading and Revenge Trading

Many traders chase losses after a bad trade, leading to overtrading. This emotional response is called revenge trading, where traders take impulsive trades to recover losses, often resulting in even bigger losses.

For example, after losing ₹10,000 in a NIFTY 50 trade, a trader might take random trades without proper analysis just to recover losses. This usually ends in disaster.

Automation prevents overtrading by limiting the number of trades per day and ensuring only the best setups are executed.

5. No Backtesting or Data-Driven Decision Making

Most traders don’t backtest their strategies. They rely on gut feeling rather than actual data, which leads to unpredictable results.

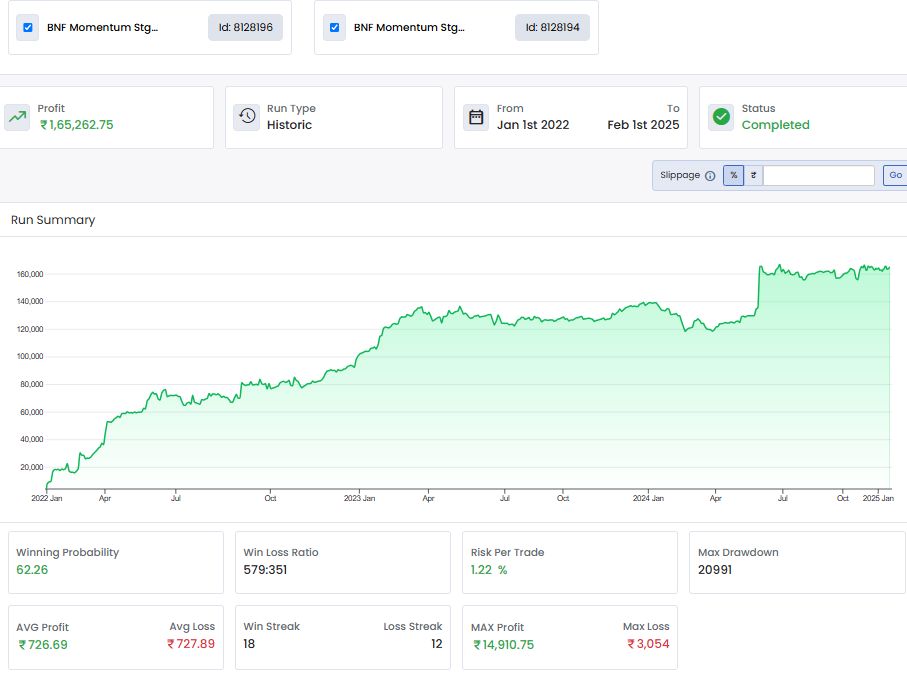

Platforms like Quantman allow traders to backtest strategies using historical data before applying them in live markets. This ensures that only profitable and well-tested strategies are used, increasing the chances of success.

For example, if a trader wants to test a strategy in Bank NIFTY, they can use Quantman to check its performance over the last 5 years before risking real money.

How Automation Helps Traders Succeed

Now that we have understood the common reasons traders fail without automation, let’s discuss how automated trading solves these problems and helps traders achieve consistent profits.

1. Eliminates Emotional Trading

Algorithms don’t have emotions. They execute trades based on logic and predefined conditions, ensuring that every trade is placed with discipline.

For example, an algo strategy in NIFTY 50 options selling will automatically square off positions at a pre-set stop-loss or profit target, removing emotional interference.

2. Ensures Discipline and Consistency

Automated trading ensures that a strategy is followed exactly as planned, without deviation.

For example, if a trader has a rule to exit a trade at a 2% loss, the algo will automatically close the trade when the limit is hit, preventing further losses.

3. Instant Order Execution for Maximum Profitability

Algo execute orders within milliseconds, ensuring the best possible entry and exit points.

For example, in Bank NIFTY scalping, an automated system can execute multiple trades in seconds, something impossible for a manual trader.

4. Prevents Overtrading and Revenge Trading

Automated trading sets daily trade limits, preventing traders from entering random trades out of frustration.

For instance, a trader using Quantman’s automated system can set a rule to stop trading after 3 consecutive losses, ensuring they don’t lose more than planned.

5. Backtesting for Data-Driven Strategies

With automation, traders can backtest their strategies to ensure they work before using them in real markets.

For example, a trader can backtest a NIFTY on Quantman to check how it performed over the past 10 years before executing it live.

6. Reduces Trading Stress and Improves Decision Making

Manual trading is mentally exhausting. With automation, traders can focus on improving strategies rather than worrying about execution.

For example, a trader using an algo to trade Bank NIFTY options can spend more time refining their strategy rather than watching charts all day.

Why Quantman is a Game-Changer for Automated Trading

Quantman is one of the best platforms for backtesting and deploying automated trading strategies. It allows traders to:

· Backtest strategies with historical data

· Optimize trading rules for better performance

· Deploy automated trading without coding

· Analyse performance metrics to improve results

For Indian traders, Quantman is an excellent platform to ensure their strategies are data-driven and profitable.

Conclusion

Most traders fail because of emotions, lack of discipline, slow execution, overtrading, and no back-testing. Automated trading solves these problems by ensuring that strategies are executed with precision, speed, and consistency.

Platforms like Quantman make it easy for traders to backtest and automate their strategies, ensuring they trade with confidence and logic.

If you want to achieve consistency in trading and avoid common mistakes, automation is the key. Embrace automated trading and take your trading journey to the next level!

Happy Trading