Why Back-tested Strategies Fail in Live Trading and How to Fix It

Introduction

Many traders spend hours developing and back-testing strategies, hoping to find the perfect system that will make them consistent profits. But when they take the strategy live, they often experience losses and unexpected failures. If a strategy worked so well in back-testing, why does it fail in real-time trading?

This is one of the biggest frustrations for traders, especially those using algorithmic trading. Understanding why back-tested strategies fail in live markets is crucial for improving trading performance.

In this blog, we will explore the reasons behind these failures and provide actionable solutions to fix them.

1. Overfitting to Historical Data

Overfitting happens when a strategy is designed too specifically for past data. It means the strategy is too perfect for historical conditions but doesn't perform well in live markets.

For Example; imagine you developed a trading strategy based on NIFTY 50 movements during 2021-2022. You optimized the strategy so well that it captured every turning point in the past data. But when you apply it in 2024, the market conditions have changed, and the strategy fails.

How to Fix It?

- Use out-of-sample testing: After creating a strategy, test it on data that wasn’t used for its development.

- Apply walk-forward optimization: This method continuously updates the strategy with new data to make it adaptive.

- Keep strategies simple: Complex strategies with too many parameters are more prone to overfitting.

2. Lack of Real Market Impact Consideration

Back-testing assumes that orders get executed at the exact price shown in historical data. But in live markets, execution depends on liquidity, slippage, and bid-ask spreads.

For Example; let’s say your back-tested strategy assumes you can buy BANK NIFTY options at ₹100. But in live markets, the bid-ask spread is wide, and by the time your order gets executed, the price has moved to ₹105. This price difference (slippage) can turn a profitable strategy into a losing one.

How to Fix It?

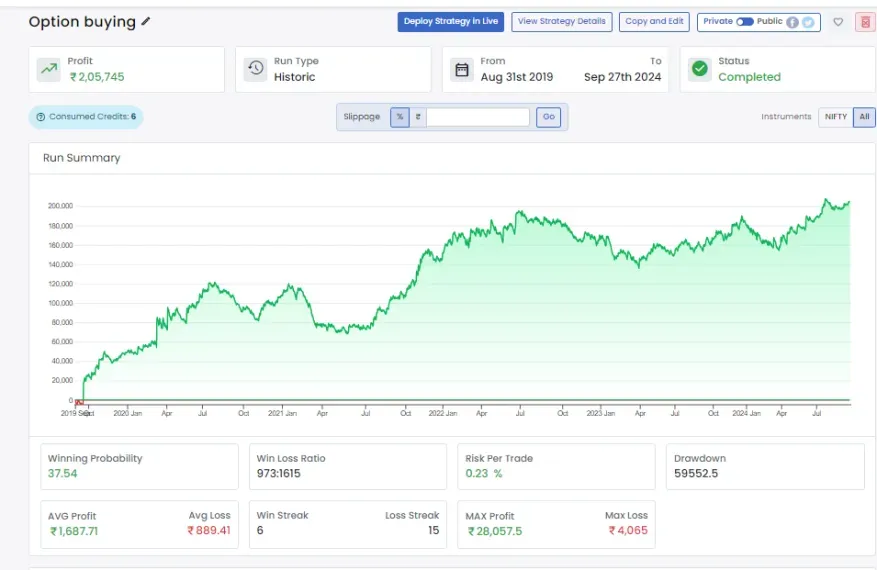

- Consider slippage and transaction costs while back-testing.

- Use limit orders instead of market orders to control execution prices.

- Back-test with real market conditions using platforms like Quantman, which offer more realistic trade execution simulations.

3. Market Conditions

Markets are dynamic. A strategy that worked well in a trending market may fail in a sideways market. Back-testing strategies on past data assume that similar conditions will continue, which is not always true.

For Example; in 2020, NIFTY 50 crashed during the COVID-19 pandemic, followed by a strong recovery in 2021. If you back-tested a trend-following strategy on that data, it would show high returns. But when markets enter a consolidation phase in 2023, the same strategy might generate losses.

How to Fix It?

- Use adaptive strategies that can switch between trend-following and mean-reversion techniques.

- Keep an eye on market conditions using volatility indicators like India VIX.

- Test strategies across different time periods to see how they perform in various market phases.

4. Ignoring Real-Time Execution Issues

Back-testing doesn’t account for latency, order execution delays, or brokerage-related issues that happen in live trading.

For Example; a scalping strategy on NIFTY might work well in back-testing, where orders are executed instantly. But in live trading, delays in placing and executing orders can lead to missed opportunities or losses.

How to Fix It?

- Use a low-latency trading platform with reliable execution speed.

- Test your strategy in a paper trading or demo account before going live.

- Use Quantman’s real-time execution testing to check order placement efficiency.

5. Psychological Factors in Live Trading

In back-testing, emotions are not involved. But in live trading, real money is at stake, and traders often make impulsive decisions.

For Example; suppose your strategy tells you to hold a trade in NIFTY 50 despite a 2% drawdown. In back-testing, you followed the rule. But in real trading, fear kicks in, and you exit early, missing the actual profit target.

How to Fix It?

- Automate trading using algo trading platforms to remove emotional bias.

- Follow a strict risk management plan.

- Start with small capital and increase gradually after gaining confidence.

6. Ignoring Risk Management

Many traders focus only on maximizing profits in back-testing and ignore risk. When live trading begins, a few bad trades can wipe out their account.

For Example; a trader places highly leveraged trades in BANK NIFTY options because back-testing showed high returns. But when markets become volatile, a single bad trade results in a massive loss.

How to Fix It?

- Use stop-loss and position sizing techniques.

- Never risk more than 1-2% of total capital per trade.

- Diversify strategies across different asset classes like futures, and options.

7. Technology and Data Quality Issues

Back-tests are done on historical data, which is often clean and free from errors. But in live trading, real-time data feeds may have missing or incorrect data points.

For Example; a trader uses a back-tested strategy on NIFTY 50 futures, assuming perfect data. But in live trading, a sudden spike due to a news event creates false signals, leading to unexpected losses.

How to Fix It?

- Use high-quality data sources for back-testing.

- Regularly monitor real-time data feeds for errors.

- Use robust algo trading platforms like Quantman, which provide accurate and reliable execution.

8. Not Adapting to New Information

Markets are influenced by news, government policies, and global events. Back-testing doesn’t factor in real-time news impact.

For Example; the RBI’s interest rate decision can impact BANK NIFTY’s volatility. A back-tested strategy might not consider sudden movements caused by news events.

How to Fix It?

- Use news-based filters to avoid trading during high-impact events.

- Apply dynamic risk management techniques to reduce exposure when uncertainty is high.

Conclusion

Back-tested strategies often fail in live trading due to overfitting, execution delays, changing market conditions, and psychological biases. However, traders can improve their success rate by using robust risk management, adaptive strategies, and reliable algo trading platforms like Quantman for accurate back-testing and real-time execution.

The key to successful trading is continuous learning and adaptation. Instead of blindly trusting back-tests, traders should validate strategies in real markets, remain flexible, and constantly improve their approach.

By applying the right techniques, traders can bridge the gap between back-tested success and live trading profitability, ensuring long-term growth in the financial markets.