Trading Mistakes That Are Wiping Out Your Profits – And How to Avoid Them

Introduction

Trading in the stock market is like playing a game of chess. Every move counts, and one wrong decision can cost you money. Many traders enter the market with high hopes of making quick returns, but they end up losing due to avoidable mistakes. The good news? You can avoid these mistakes and protect your precious savings.

In this blog, we will discuss the most common trading mistakes that drain your profits and how you can avoid them. Additionally, we will see how algo trading platforms like Quantman can help traders avoid these mistakes and maximize their profits.

By the end of this blog, you will have a clear understanding of what NOT to do in trading and how to become a better.

1. Trading Without a Plan

One of the biggest mistakes traders make is jumping into the market without a proper plan. Trading without a plan is like driving without a map you don’t know where you are going, and youll likely get lost.

For example; imagine you decide to trade Bank Nifty options because you saw a sudden movement in the price. You enter the trade without any analysis, stop-loss, or target in mind. The market moves against you, and you panic, resulting in a huge loss.

How to Avoid This Mistake?

- Always have a clear trading plan before entering a trade.

- Your plan should include entry and exit points, stop-loss, target, and risk management strategy.

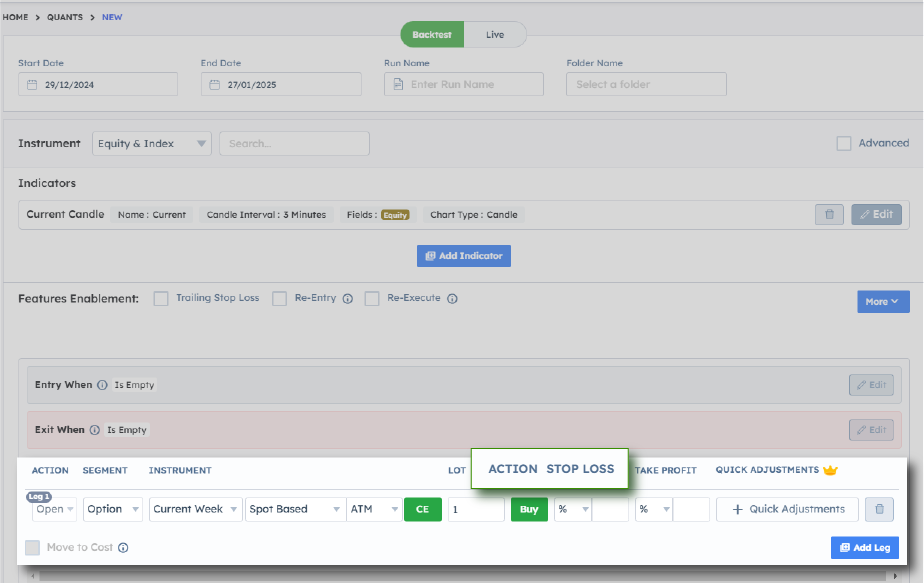

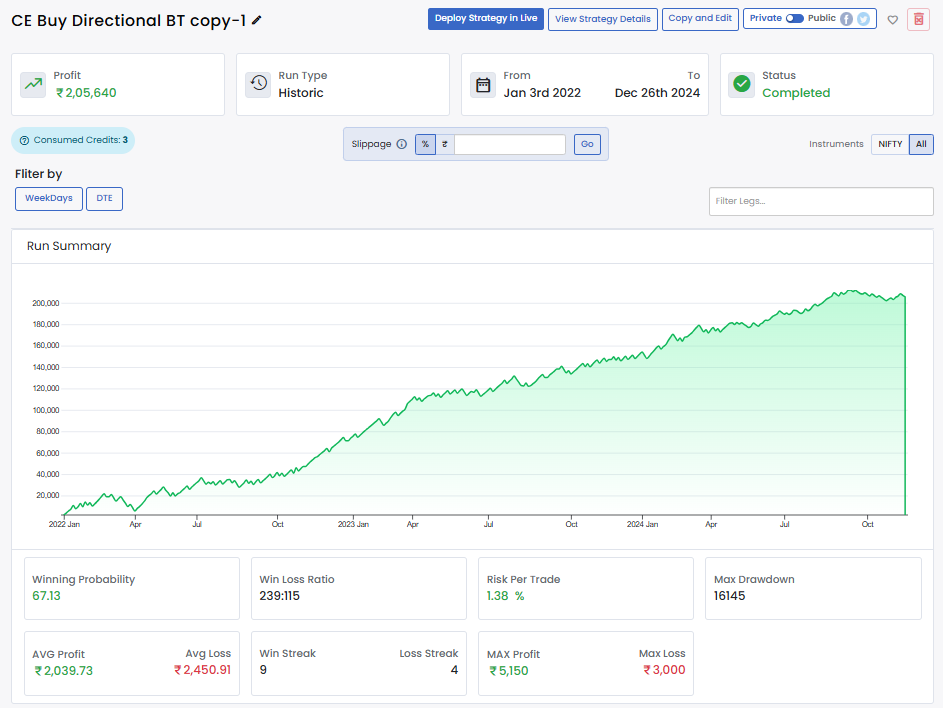

- Use back-testing tools like Quantman to test your trading strategy before applying it in the live market.

2. Ignoring Risk Management

Most traders focus only on how much profit they can make but ignore the risk involved. This is a major reason why many traders lose money.

For Example; Let’s say you invest ₹1,00,000 in a trade without setting a stop-loss. The trade goes against you, and your loss reaches ₹50,000. If you had followed proper risk management and placed a stop-loss, you might have lost only ₹5,000 or ₹10,000 instead of half your capital.

How to Avoid This Mistake?

- Never risk more than 2% of your trading capital on a single trade.

- Always use a stop-loss to protect your capital.

- Use algo trading platforms like Quantman to automate stop-loss placement and prevent emotional trading mistakes.

3. Overtrading

Many traders believe that the more they trade, the more they earn. This is a wrong mind-set. Overtrading leads to high brokerage costs, emotional exhaustion, and poor decision-making.

For Example; a trader sees Nifty 50 moving up and buys multiple trades in excitement. Then, the market suddenly reverses, and all his positions are in loss. Instead of stopping, he takes another trade to recover losses, which leads to even bigger losses.

How to Avoid This Mistake?

- Trade only when there is a clear setup do not trade just because the market is open.

- Set a daily and weekly trade limit to avoid excessive trading.

- Use algo trading with Quantman to ensure you enter only high-probability trades.

4. Letting Emotions Control Your Trading

Fear and greed are the biggest enemies of a trader. Emotional trading leads to bad decisions, holding onto losing trades, and exiting profitable trades too early.

For Example; you buy Reliance Industries stock at ₹2500, and it moves up to ₹2550. You get scared that the price might fall, so you book profits early. Later, the stock moves up to ₹2700, and you regret selling too soon.

On the other hand, when a trade goes into loss, you hope the price will come back up and do not exit, resulting in even bigger losses.

How to Avoid This Mistake?

- Follow a strict trading plan and do not let emotions take over.

- Use stop-loss and target orders so that you don’t have to make emotional decisions.

- Algo trading platforms like Quantman help remove emotional bias by executing trades automatically based on predefined rules.

5. Chasing the Market

Many traders enter a trade when they see a big green candle price going up quickly and sell when they see a red candle price falling. This leads to buying at high prices and selling at low prices—exactly the opposite of what you should do.

For Example; you see Sensex jumping 500 points in a few minutes and enter a trade at the peak, thinking it will go higher. Soon, the market reverses, and you are stuck at a high price.

How to Avoid This Mistake?

- Never chase a moving market. Wait for a proper pullback before entering a trade.

- Use technical analysis tools like support & resistance, moving averages, and volume indicators to identify the right entry points.

- Back-test your strategy with Quantman to check if it works in different market conditions.

6. Not Understanding Market Trends

Trading against the trend is one of the fastest ways to lose money. The trend is your friend always trade in the direction of the market trend.

For Example; if Nifty 50 is in a strong uptrend, but you keep selling because you think it is too high, you will lose money. Similarly, if the market is crashing and you keep buying, you are fighting against the trend.

How to Avoid This Mistake?

- Identify the trend using moving averages, trendlines, and market structure.

- Trade in the direction of the trend instead of trying to predict reversals.

- Use algo trading tools like Quantman to identify trend-based opportunities.

7. Ignoring News and Events

News and economic events have a huge impact on the stock market. If you ignore them, you might get caught in unexpected market movements.

For Example; imagine you take a trade in Bank Nifty just before the RBI policy announcement. The market reacts strongly, and your trade gets stopped out due to high volatility.

How to Avoid This Mistake?

- Keep track of important news, economic events, and corporate earnings.

- Avoid trading during high-impact events unless you have a specific strategy for it.

- Use Quantman’s data analytics to analyse how news affects different stocks and indices.

8. Not Using Algo Trading to Your Advantage

Many traders still rely on manual trading, which is slow and prone to human errors. Algo trading platforms like Quantman allow traders to execute trades faster, follow rules strictly, and remove emotional biases.

Advantages of Algo Trading with Quantman:

Eliminates emotions: Trades are executed based on logic, not feelings.

Faster execution: Algo trading executes trades in milliseconds, ensuring you don’t miss opportunities.

Back-testing strategy: You can test your strategy on historical data before applying it in real-time.

Automated risk management: Stop-loss and target orders are placed automatically, reducing losses.

Saves time: No need to sit in front of the screen all day; the system trades for you.

Conclusion

Trading is a skill that requires discipline, planning, and continuous learning. Most traders lose money because they make the same mistakes repeatedly. By avoiding these common mistakes such as trading without a plan, ignoring risk management, overtrading, and letting emotions control your decisions you can increase your chances of success.

Using algo trading platforms like Quantman can help you trade efficiently, remove emotional bias, and execute trades faster. Remember, trading is not about making money fast it’s about making smart decisions consistently.

Avoid these mistakes, stay disciplined, and watch your trading returns grow!