Quick Adjustment in Trading: A Simple Way to Stay Ahead in Market

Introduction

Trading in the stock market is not just about entering positions; it’s also about managing them effectively. One of the key aspects of trade management is making quick adjustments to adapt to market conditions. Quick adjustments can help traders protect profits, minimize losses, and optimize overall portfolio performance.

In this blog, we will discuss how quick adjustments work, how traders can use them efficiently, and how Quantman provides an excellent platform to execute these adjustments seamlessly. We will also cover real-time examples from the Indian stock market, making it easier for traders to relate and implement in their own strategies.

What are Quick Adjustments?

Quick adjustments are predefined trading rules that help traders take automated actions based on market movements. These adjustments ensure that a position is managed without emotional bias and executed precisely when needed.

For example, if a trader enters a position and wants to protect their profit or manage risk effectively, they can set a quick adjustment rule like:

- Exit a position if it reaches a certain profit level.

- Move the stop loss to cost if the trade starts going against expectations.

- Hedge or close a specific leg of a strategy when a predefined condition is met.

These quick actions help in managing a trade automatically and efficiently.

Key Elements of Quick Adjustments

While using quick adjustments, a trader can configure several parameters. Let's go through the most important ones:

1. Exit in Profit

If a position is in profit, the system can be set to close the trade or adjust it for further gains. For Example: You enter a Bank Nifty Call Option trade at 200. If it reaches 250, you can set a rule to close the trade and book profit automatically.

2. Exit in Loss

If a trade moves against you, the system can adjust or close the position before the loss worsens. For Example; you sell a Reliance Put Option at 50. If it reaches 70, the system can automatically move the stop loss or exit the trade.

3. Move to Cost

This ensures that once a trade moves in favour, the stop loss is adjusted to the entry price, securing a risk-free trade. For Example; you buy TCS Futures at ₹3,500, and the stock moves to ₹3,520. The stop loss is moved to ₹3,500, ensuring zero loss.

4. Hedging Adjustments

The system can add a hedge by buying protective options if the market turns volatile. For Example; if you are shorting Nifty futures and it starts moving against you, the system can buy a Call Option as a hedge.

5. Time-Based Adjustments

Traders can schedule adjustments based on specific timeframes. For Example; if an Iron Condor strategy is running till 2:30 PM, the system can automatically close the losing leg and adjust for expiry trades.

Let’s Create a Simple Strategy

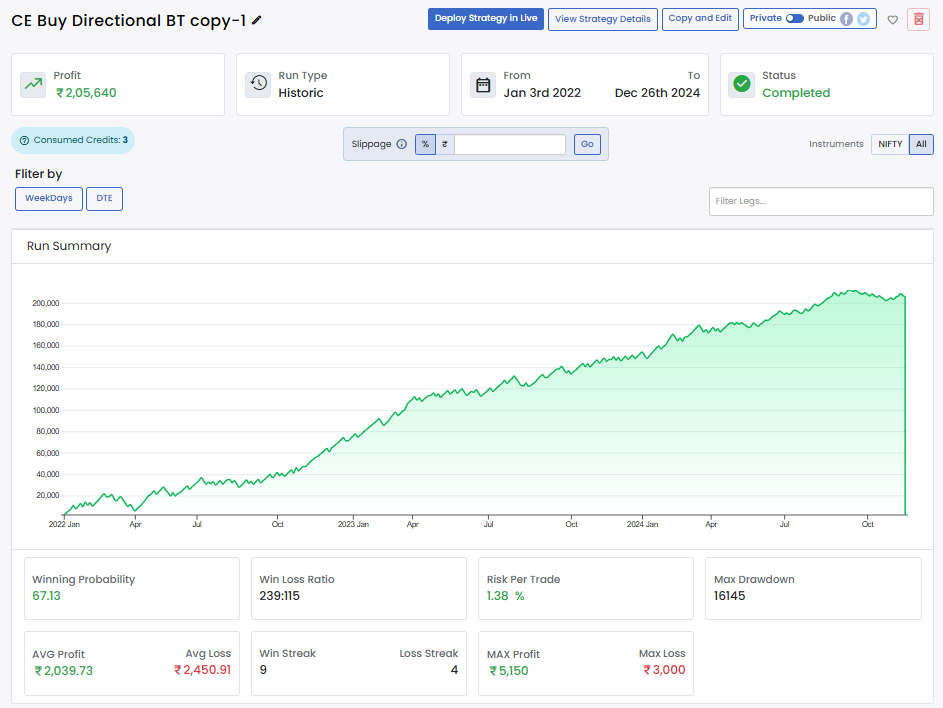

Will be adding instrument as Nifty and will back-test from 2022

Step: 1 Adding Entry Condition

Current Close is above middle Bollinger Band. This suggests the market is in uptrend, which means it's likely to continue rising, so it's a good time to sell a call options.

Super Trend Indicator: The Current Close is above the Super Trend confirms that the market is in an uptrend. The Super Trend helps identify the direction of the trend, and when the price is above it, it signals bullish momentum.

CPR (Central Pivot Range): When the current close is above CPR R1, it reinforces the idea is to that the market is bullish.

If these condition matches the trade will be executed

Step: 2 Adding legs

Once all these conditions are met, we proceed with buying an at-the-money (ATM) call option. This is a directional option buying which captures the uptrend. Our goal is to capture the trend.

Take Profit:

Our target is 25-point profit. Once we reach this, we exit the trade to lock in profits.

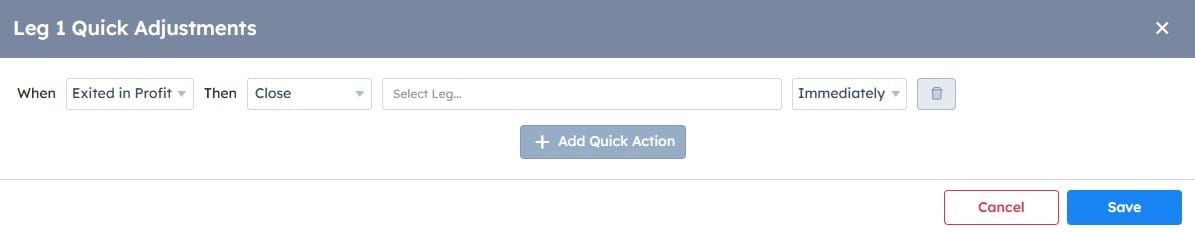

Quick Adjustment for Leg 1:

- If Leg 1 exits in profit after the 25-point target, we close Leg immediately.

Step: 3 Adding Adjustment

If Leg 1 already exit with a loss, will add new leg:

- Buy 4 lots of ATM put option. Increasing the lots helps in recovering losses much more effectively in case of a trend reverses.

- We set a stop loss and take profit of 10 points and 25 points respectively, just like Leg 1.

Quick Adjustment for Leg 2:

- If Leg 2 exits in profit after the 25-point target, we close Leg immediately.

Daily Target:

We set a daily profit target of ₹1800. Once we achieve this profit, we close all positions. This helps in managing risk and locking in profits and the trade won’t be executed for rest of the day.

Advantages of Using Quick Adjustments

· No Need for Constant Monitoring

Quick Adjustments automate trade management, so you don’t have to sit in front of the screen all day.

· Protects Profits and Minimizes Losses

By moving the stop-loss to cost price or closing a trade when a target is reached, Quick Adjustments help secure gains and reduce risk.

· Works Well in Volatile Markets

Indian markets, especially NIFTY and BANK NIFTY, are highly volatile. Quick Adjustments ensure that you don’t miss out on opportunities or suffer unexpected losses.

· Reduces Emotional Trading

Many traders make impulsive decisions due to fear or greed. Quick Adjustments remove emotions from trading by executing predefined rules.

· Increases Trading Efficiency

With automated adjustments, traders can focus on strategy-building rather than manual execution, leading to better decision-making.

Conclusion

Quick adjustments are an essential part of successful trading. They help traders reduce losses, manage risk, and maximize profits without completely exiting a position.

With algo trading platforms like Quantman, traders can automate quick adjustments, removing emotions from trading and improving efficiency. By setting predefined rules and automated hedging, traders can adapt to market movements instantly.

If you want to trade smartly and stay ahead in the market, mastering quick adjustments is the key. Start implementing these strategies today and take your trading to the next level.