How to Use Combined Portfolio Results: A Simple Guide

Introduction

In the fast-moving world of algorithmic trading, analysing multiple strategies efficiently is crucial for making informed decisions. We at Quantman understand this need and are excited to introduce our latest feature Combined Portfolio Results!

Now, you can view the performance of multiple strategies together in a single, unified view. This means better insights, improved decision-making, and a more comprehensive trading approach.

With this new feature, traders can analyse how different strategies perform collectively rather than viewing them in isolation. This is a game-changer for those who rely on multiple strategies to maximize their trading potential.

What is the Combined Portfolio Results Feature?

The Combined Portfolio Results feature allows you to merge multiple trading strategies into one portfolio and analyse their combined performance. Instead of reviewing each strategy separately, you can now see how they work together, giving you a holistic view of your overall trading approach.

This feature helps traders:

- Compare different strategies and it provides consolidated results.

- Assess overall risk and return.

- Identify the best strategy combinations.

- Improve diversification and risk management.

How to Use the Combined Results Feature?

Using the Combined Portfolio Results feature is simple and straightforward. Follow these easy steps:

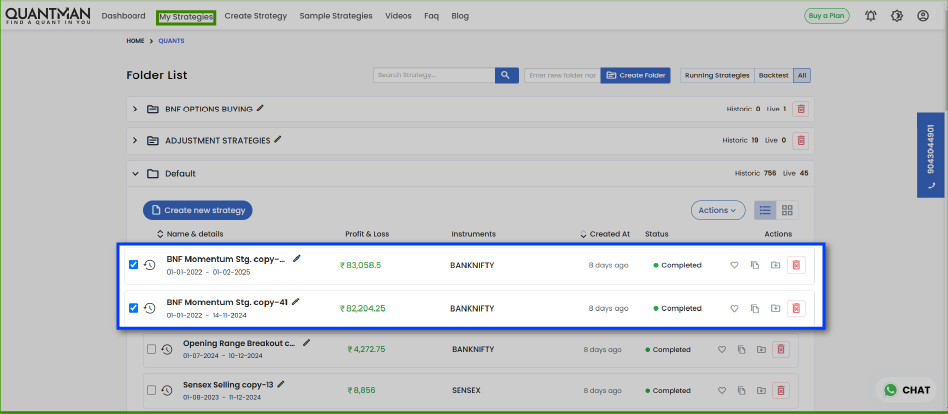

Step 1: Go to My Strategy Page

Log in to your Quantman account and navigate to the My Strategy page. This is where all your saved strategies are listed.

Step 2: Select Multiple Strategies

Choose the strategies that you want to analyze together. You can select as many as you want, but we recommend picking strategies that complement each other to get meaningful insights.

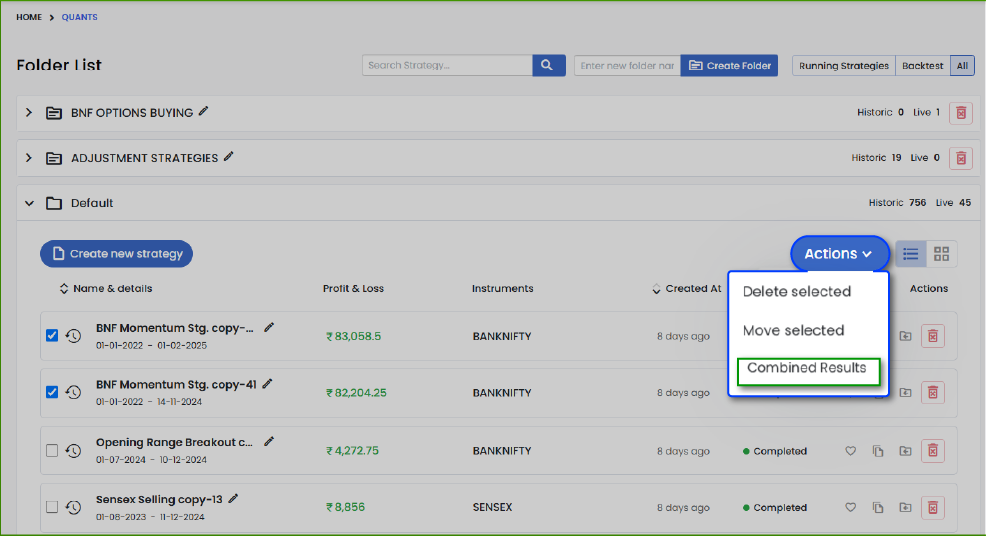

Step 3: Click on ‘Combine Results’

After selecting the strategies, click on the ‘Combine Results’ button. This will generate a report showing the overall performance of the selected strategies.

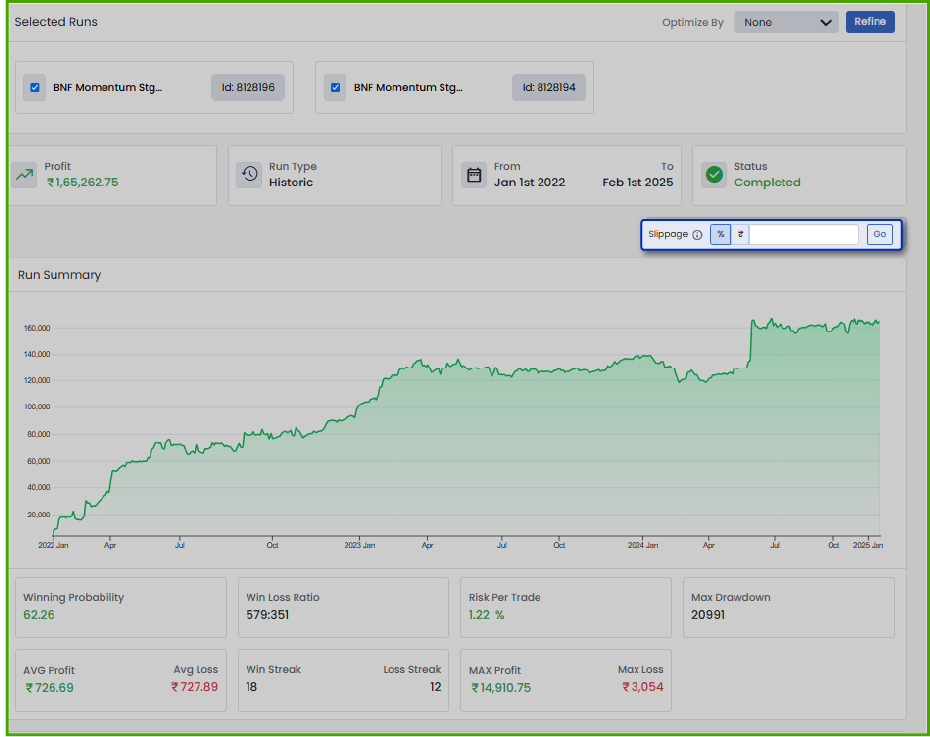

Step 4: Add Slippage to the Results

To make your results more realistic, we recommend adding slippage to the performance summary.

What is Slippage?

Slippage refers to the difference between the expected price of a trade and the actual price at which the trade is executed. It occurs due to market volatility and liquidity issues. Factoring in slippage helps in:

- Getting a more accurate picture of your trading performance.

- Understanding the impact of real-time execution delays.

- Making better trading decisions based on realistic expectations.

To add slippage in Quantman, simply enter your estimated slippage percentage, and the system will adjust the results accordingly.

Why Use the Combined Portfolio Results Feature?

Better Strategy Analysis

Instead of testing strategies in isolation, you can now see how they interact with each other.

Enhanced Portfolio Management

By combining different strategies, you can balance risks and maximize profits.

Improved Realism with Slippage Adjustment

Factoring in slippage ensures that your trading performance reflects real market conditions.

Save Time & Increase Efficiency

No need to manually compare results. Quantman does it all in one click!

Conclusion

With the Combined Portfolio Results feature, Quantman makes it easier than ever to analyse and optimize multiple trading strategies. This tool is designed to help traders make smarter decisions, reduce risks, and enhance their overall trading experience.

So, what are you waiting for? Log in to Quantman today and try out this exclusive feature!